Financers pressure shipping industry to clean up its recycling practices

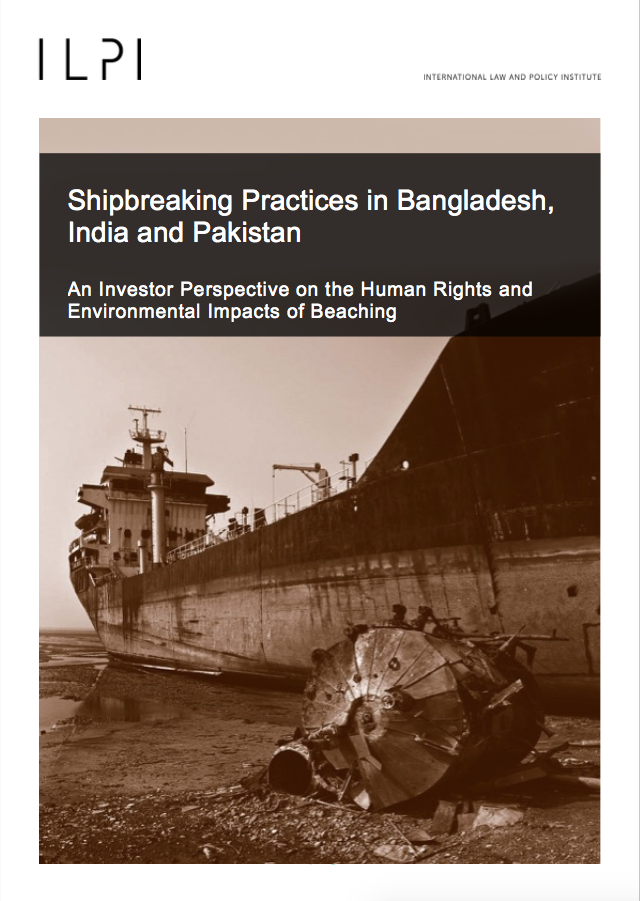

Banks, pension funds and other financial institutions are increasingly asked to take into account social, environmental and governance criteria when selecting asset values or clients. Investing with an eye to environmental or social issues, not just financial returns, is in demand, and the credit providers and investors of shipping are now actively taking a closer look at how they might contribute to a shift towards better ship recycling practices off the beach.

Through what is known as “negative screening”, investors are using the annual lists that the Platform publishes on global dumpers to screen their portfolio. In 2018, Scandinavian pension funds the Norwegian Government Pension Fund Global and KLP divested from four shipping companies due to their beaching practices. The exclusions were made public and with written explanations. Both the breach of international human rights and the severe environmental damage caused by beaching were highlighted as reasons for the divestments.

Banks play a crucial role in supporting economic activity through their lending. They can also influence better business practices through engaging with their clients on social, environmental and governance matters. Starting off as a Dutch bank initiative with NIBC, ING and ABN AMRO as founding members, large Scandinavian and German shipping banks are now also part of a group of banks that promote responsible ship recycling and negotiate clauses to that aim in the loan agreements they sign with shipping companies.

The financers of shipping have signaled that there are likely further exclusions to come. In light of the announced decommissioning in the oil and gas sector, it is further likely that investments in oil and gas assets will be also scrutinized.

RECOMMENDED READINGS

Latest News

Platform publishes South Asia Quarterly Update #37

Eight workers suffered an accident on South Asian beaches in the first quarter of 2024.

... Read MoreRelated news

Platform News – Norwegian pension funds turn their attention towards Indian shipbreaking practices

Last week the Council on Ethics of the Norwegian oil pension fund (Government Pension Fund Global) announced that it will turn its attention towards Indian shipbreaking practices…. Read More

Press Release – Turning point: new tech and developments for a new future of ship recycling presented at the Lab

Stakeholders that are pioneering a new future for sustainable ship recycling gathered in Rotterdam at the NGO Shipbreaking Platform’s Ship Recycling Lab.

... Read More

Platform News – REMINDER: Ship Recycling Lab on 20-21 September in Rotterdam

The NGO Shipbreaking Platform invites you to attend the conference Ship Recycling Lab on 20-21 September in Rotterdam (Netherlands).

... Read More

Press Release – Container shipping asked to clean up its act in view of upcoming scrapping wave

Numerous container ships are predicted to be sold for scrapping in the near future.

... Read More